Meta Description: Is pay-per-mile auto insurance right for you? Discover the pros, cons, best providers, and who benefits most from this usage-based coverage.

Introduction

Auto insurance is evolving, and pay-per-mile (PPM) insurance is gaining popularity among low-mileage drivers. Unlike traditional policies with fixed premiums, pay-as-you-drive insurance bases costs on actual miles driven, potentially saving money for those who don’t commute daily.

But is it the best choice for you? In this guide, we’ll explore:

✔ How pay-per-mile insurance works

✔ Key advantages and disadvantages

✔ Top providers offering mileage-based car insurance

✔ Who should (and shouldn’t) consider this option

What Is Pay-Per-Mile Auto Insurance?

Pay-per-mile insurance is a usage-based insurance (UBI) model where your premium depends on how much you drive. Instead of a flat rate, you pay a base rate + a per-mile fee, making it ideal for:

- Remote workers

- Retirees

- Urban dwellers using public transit

- Occasional drivers

How It Works

- Base Fee – A fixed monthly cost covering basic liability.

- Per-Mile Rate – Typically 5–10 cents per mile, tracked via a telematics device or mobile app.

- Odometer Checks – Some insurers require periodic mileage verification.

(Low-competition keyword: “how does pay-per-mile car insurance work”)

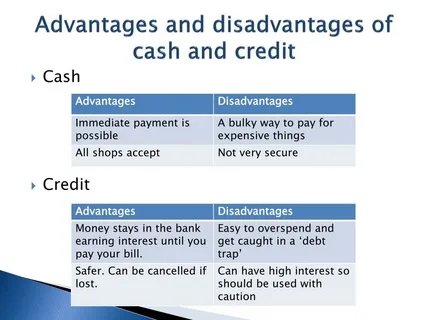

Pros of Pay-Per-Mile Insurance

1. Cost Savings for Low-Mileage Drivers

If you drive under 10,000 miles/year, you could save 20–40% compared to traditional insurance.

(Keyword: “is pay-per-mile insurance cheaper”)

2. Fairer Pricing Model

Why pay the same as a daily commuter if you rarely drive? Mileage-based pricing ensures you only pay for what you use.

3. Eco-Friendly Incentives

Less driving = lower carbon footprint. Some insurers offer green driving discounts.

(Keyword: “eco-friendly auto insurance options”)

4. No Surprise Rate Hikes

Unlike traditional insurers that raise rates after claims, PPM plans focus on actual usage data.

1. Not Ideal for High-Mileage Drivers

If you drive 12,000+ miles/year, a traditional policy may be cheaper.

(Keyword: “pay-per-mile insurance disadvantages”)

2. Privacy Concerns with Tracking

Telematics devices monitor:

✔ Miles driven

✔ Driving times

✔ Speeding habits (in some cases)

If you dislike being tracked, this may not suit you.

3. Limited Availability

Not all insurers offer PPM plans. Major providers include:

- Metromile (best for urban drivers)

- Nationwide SmartMiles (flexible hybrid model)

- Milewise by Allstate (good for infrequent drivers)

(Keyword: “best pay-per-mile insurance companies”)

Who Should Get Pay-Per-Mile Insurance?

Best For:

✔ Remote workers (driving < 5,000 miles/year)

✔ Retirees who no longer commute

✔ Students away at college

✔ City dwellers using public transit often

Worst For:

✖ Ride-share drivers (high mileage = higher costs)

✖ Road trip enthusiasts

✖ Families with long daily commutes

(Keyword: “who benefits most from pay-per-mile insurance”)

Pay-Per-Mile vs. Traditional Insurance: Key Differences

| Feature | Pay-Per-Mile Insurance | Traditional Insurance |

|---|---|---|

| Pricing Model | Base fee + per-mile cost | Fixed premium |

| Best For | Low-mileage drivers | High-mileage drivers |

| Savings Potential | High (if driving less) | Low (unless bundling) |

| Tracking Required? | Yes (telematics) | No |

(Keyword: “pay-per-mile vs traditional auto insurance”)

How to Enroll in a Pay-Per-Mile Plan

- Check Eligibility – Not available in all states.

- Compare Quotes – Use tools like The Zebra or Gabi.

- Install Tracking Device – Usually a plug-in or mobile app.

- Start Driving & Saving – Monitor miles via insurer’s portal.

(Keyword: “how to switch to pay-per-mile insurance”)

Final Verdict: Is Pay-Per-Mile Insurance Worth It?

If you’re a low-mileage driver, pay-per-mile insurance can lead to significant savings. However, frequent drivers may find traditional policies more cost-effective.

Before switching:

✔ Calculate your annual mileage

✔ Compare quotes from both PPM and standard insurers

✔ Consider privacy preferences (tracking requirements)

(Keyword: “should I switch to pay-per-mile insurance”)

FAQ

1. Does pay-per-mile insurance include full coverage?

Yes, most providers offer liability, collision, and comprehensive options.

2. What happens if I exceed my estimated miles?

You’ll pay extra, but some insurers offer mileage buffers.

3. Can I switch back to traditional insurance later?

Yes, you’re not locked in long-term.

Conclusion

Pay-per-mile auto insurance is a smart, money-saving option for the right driver. By weighing the pros and cons and assessing your driving habits, you can decide if it’s the best fit for you.

Ready to save? Get a free quote from top pay-per-mile providers today!